Content provided by Pickering and Rye

Contact Pickering and Rye here

When the Junior ISA annual allowance was more than doubled in the March Budget, it was a welcome move; one that cemented the scheme as a core part of government attempts to encourage long-term saving.

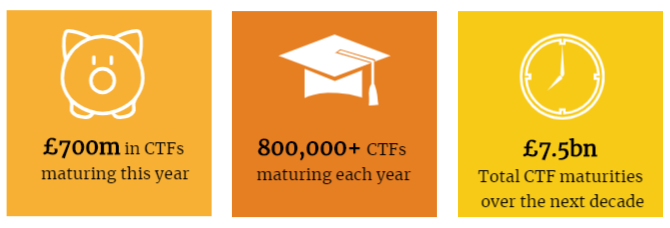

The change to Child Trust Funds (CTFs) – the Junior ISA’s less successful predecessor – announced earlier this year was not so well publicised, but should also help young adults to maintain the savings habit. It was also a timely one, as the first tranche of CTFs mature this September. Over six million youngsters have CTF savings and it’s reckoned that funds worth £700 million will mature in this tax year.¹

Under the previous rules, the only option was to cash in the CTF when the child turned 18. Now, savers can transfer the funds directly into an ISA on maturity, preserving the tax benefits. If no instruction is received from the holder, CTF providers will be able to automatically transfer the funds into an ISA. What’s more, the amount transferred does not affect the saver’s existing annual ISA allowance.

Source: HMRC/Quilter, January 2020

Savings bonus

The CTF scheme was available to every child born between 1 September 2002 and 2 January 2011. The government gave a voucher for £250 to parents or guardians of qualifying children (£500 for low-income families); a bonus intended to encourage parents to save more. The annual allowance for this tax year is £9,000 – the same as for Junior ISAs. All savings held in a CTF are free from any further liability for Income Tax or Capital Gains Tax. The money is locked in until the child’s 18th birthday.

In 2011, new CTFs were stopped when the government introduced the Junior ISA. Unlike with the CTF, Junior ISAs do not benefit from a government bonus, and are not opened automatically. However, they have proved very popular with parents and other family members, offering more flexibility, a wider choice of investments and, typically, lower costs.

There are a handful of cash CTFs still operating, on which the rates being offered are poor in relation to Junior Cash ISAs. The most popular type of account is a ‘stakeholder’ CTF, the majority of which are invested in UK index tracker funds. Charges in a CTF are capped at 1.5%, but this is a relatively high fee for an index tracker investment.

Thinking ahead

After the Junior ISA was introduced, campaigners were quick to call for the ability to transfer funds held in inferior CTFs into the new scheme. In 2015, the government changed the rules to allow these transfers. It means parents don’t have to wait until the child is 18 to get the funds into an ISA wrapper, offering the potential for savers to benefit from lower charges, more investment choices, and better returns.

“For the youngest holders, there are still nine years before their CTF reaches maturity. It’s therefore worth considering whether that time would be better spent invested in a Junior ISA,” says Andrew Shaw, Head of Investment Communications at St. James’s Place. “And the rule change further means that the tax shelter for the money can be retained beyond that point.”

It’s estimated that around one in four CTFs is ‘lost’, where families have forgotten they exist, lost track of where they are invested or mislaid the details of how to access them.² Parents in that situation can track down their CTF provider by using the help tool on the HMRC website. The rule change means unclaimed CTFs will be moved into an ISA automatically on maturity.

As part of a new tax year ‘spring clean’, it might be worthwhile parents dusting off their CTF paperwork and considering whether they can save more for their children; and if a Junior ISA might offer better prospects for when they reach adulthood, and beyond.

¹ HMRC, January 2020

² OneFamily, January 2020

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select, and the value can therefore go down as well as up. You may get back less than you invested.

An investment in equities (funds) does not provide the security of capital associated with a Cash ISA or a deposit account with a bank or building society.